INTERNATIONAL EMPLOYER OF RECORD PAYROLL

Working on an Employer of Record (EoR) basis, Binks Overseas becomes the in-country employer, handling employment contracts and taking responsibility for the employment. This is often a good option for new companies who prefer to outsource this function rather than establish their own in-country entity.

We use a combination of internally managed payroll and outsourced payroll partners who are specialists in employment and tax laws in-country thus ensuring local compliance. Our knowledgeable team are experienced in using specialist payroll software which report electronically to the relevant tax authorities.

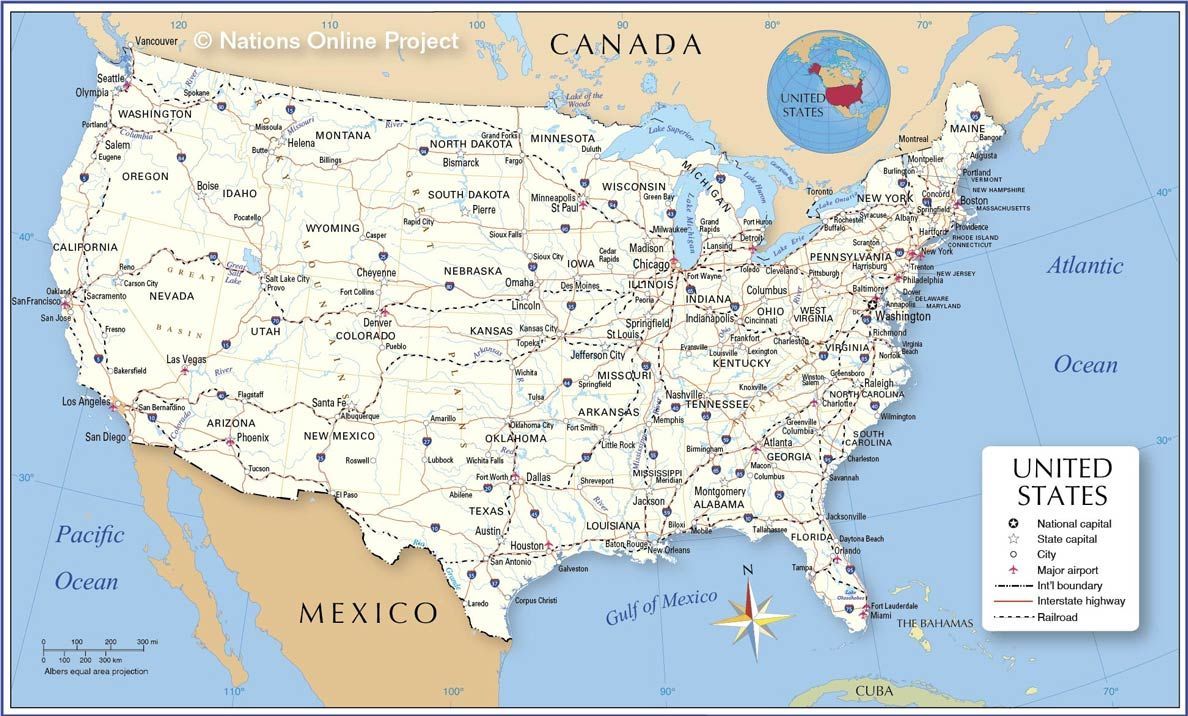

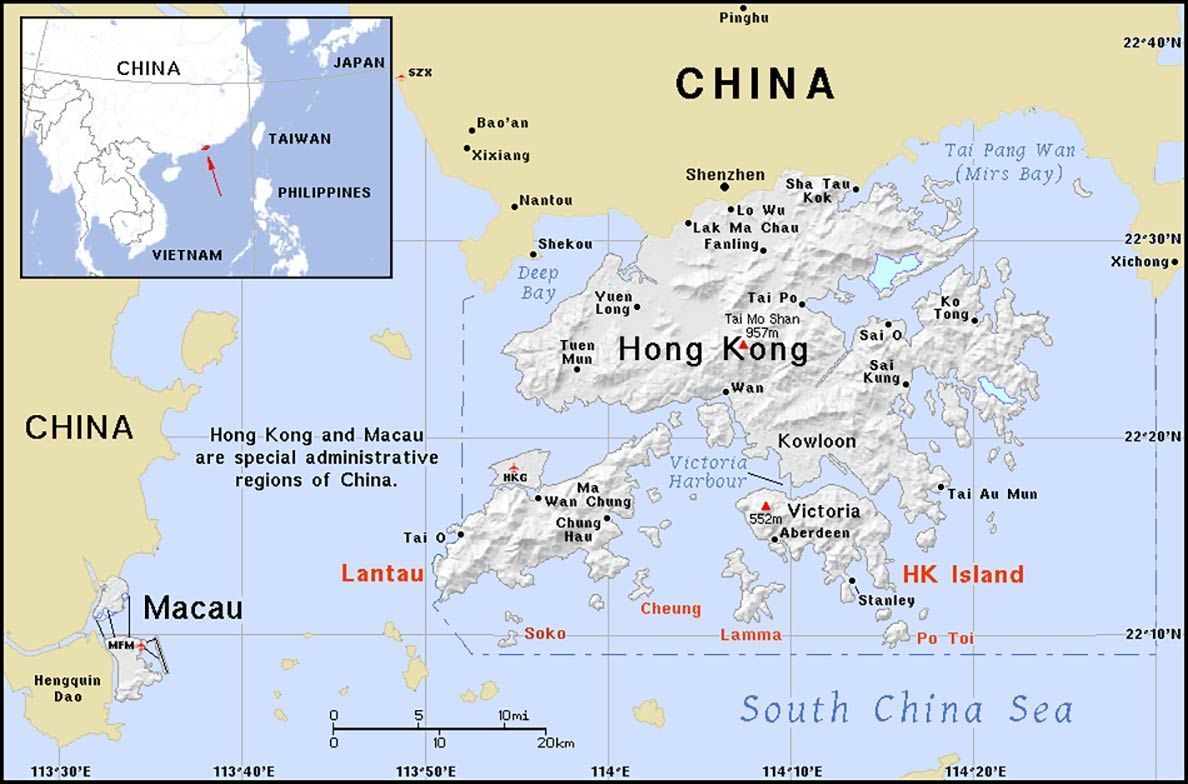

Click on the country on the map below to see details of the payroll solutions in that country

The Process

1.

The client will contact Binks to enquire about an EoR solution in the country required.

2.

Confirmation of an available payroll solution and the costs per calendar month are confirmed by Binks.

3.

The client supplies a summary of the assignment. This may include a contract or contract details and a work order or call-off summary.

4.

The new employee is invited to the payroll by the onboarding team who draft a bespoke employment contract that mirrors the assignment brief given. All employment contracts are locally compliant according to relevant employment legislation

5.

A welcome email is sent to the employee with the contract and explaining what documents are required – typically passport, proof of address and full bank details.

6.

Onboarding completed, the employee can begin the work

7.

Every month the employee or client will send a timesheet (or similar) or, if on a fixed salary, confirm all relevant payroll data for the monthly salary to be calculated

8.

Payroll is run for the month and the employee is provided with a payslip.

Fees & Employers Costs

Fees are calculated on a calendar month basis, the fee may be paid by the employee (where it is deducted from gross salary) or the client may choose to cover the cost. Employers employment-related costs are also treated in the same way.

Contact Us

Additional Services

As the employer of record Binks is able to support workers with applications for ID cards and mandatory regulatory paperwork for specific industries - such as construction sites.

This includes:

A1 Applications ID06 Cards (Sweden)

HMS Kort (Norway) Valltti & Limosa Cards (Finland)

Dutch BSN Numbers Norwegian D Numbers

Danish CPR Numbers Posted Worker Notifications

Austria

Local Employment Facts

- No official minimum wage but Lohnund Sozialdumping-Bekämpfungsgesetz suggest €1700/Month

- 13/14th Month – YES

- Working hours – 40/Week

- Holidays – 25 days

- Sick pay – 6 weeks at 100% and 4 weeks at 50% in year 1. Year 2-15 = 8 weeks at 100% and 4 weeks at 50% (Employer)

Croatia

Local Employment Facts

- Minimum wage - €700/Month

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 20 days

- Sick pay – 42 days at 70% (Employer)

- Tax Schemes – Digital Nomads (0% for 1 year)

Czech Republic

Local Employment Facts

- Minimum wage - 17,300 CZK/Month

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 20 days

- Sick pay – 14 days at 60% (Employer)

- Tax Schemes – Tax credits awarded (general 30,840/Month)

Denmark

Local Employment Facts

- Minimum wage - €700/Month

- 13/14th Month – NO

- Working hours – 37.5/Week

- Holidays – 25 days plus 1% holiday supplement

- Sick pay – 30 days at 100% (Employer)

- Tax Schemes – Ex-pat/Highly Skilled/Researcher Scheme (26% tax)

France

Local Employment Facts

- Minimum wage - €1709.30/Month

- 13/14th Month – 13th Month at year end

- Working hours – 35/Week

- Holidays – 5 weeks

- Sick pay – YES through Social Security

- Mandatory Health and sickness/Death Insurance part of SI

Finland

Local Employment Facts

- Minimum wage – None reported

- 13/14th Month – 13th Month customary

- Working hours – 40/Week

- Holidays – 24 days

- Sick pay – 4 weeks at 100% (Employer)

Germany

Local Employment Facts

- Minimum wage – €12 per hour

- 13/14th Month – 13th Month customary in Dec

- Working hours – 40/Week

- Holidays – 20 days

- Sick pay – 6 weeks at 100% (Employer)

Greece

Local Employment Facts

- Minimum wage – €780/Month

- 13/14th Month – Additional salary Xmas (equivalent 1 month) and Easter/Vacation (50% of 1 month) – 3 extra payments

- Working hours – 40/Week

- Holidays – 20 days in year 1 and raising proportionally

- Sick pay – In Years 1-4 = 1 month at 100%, Years 4-10 = 3 months at 100% (Employer)

Hong Kong

Local Employment Facts

- Minimum wage – 40 HKD per hour

- 13/14th Month – 13th month at Lunar New Year

- Working hours – 40/Week

- Holidays – 7 days

- Sick pay – 2 days per month at 80% (1st year service)

Hungary

Local Employment Facts

- Minimum wage – HUF 232,000 upto HUF 296,000

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 20 days

- Sick pay – 15 days at 70% (Employer)

Ireland

Local Employment Facts

- Minimum wage – €11.30 per hour

- 13/14th Month – NO

- Working hours – 39/Week

- Holidays – 20 days

- Sick pay – 3 days at 70% per year (Employer)

Italy

Local Employment Facts

- Minimum wage – NO stat minimum

- 13/14th Month – Both – paid June/Dec

- Working hours – 40/Week

- Holidays – 4 weeks

- Sick pay – 3 days at 100% (1st & 2nd incident), 3 days at 66% (3rd incident) and 3 days at 50% (4th incident) (Employer)

Netherlands

Local Employment Facts

- Minimum wage – €1934.40/Month

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 20 days

- Sick pay – 1 year at 70% (Employer)

- 30% ruling can be awarded in some cases

Norway

Local Employment Facts

- Minimum wage – NO Minimum

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 21 days

- Sick pay – 16 days at 100% (Employer)

Poland

Local Employment Facts

- Minimum wage – PLN 3490/Month

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 20 days raising to 26 days after 10 years service

- Sick pay – 33 days at 100% if under 50 and 14 days at 100% if over 50 (Employer)

Portugal

Local Employment Facts

- Minimum wage – €760/Month based on 14 months

- 13/14th Month – Both – paid June/Dec

- Working hours – 40/Week

- Holidays – 22 days

- Sick pay – 3 days at 100% (Employer)

Romania

Local Employment Facts

- Minimum wage – RON3000/Month

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 20 days

- Sick pay – 5 days at 75/100% (illness dependent)(Employer)

Slovakia

Local Employment Facts

- Minimum wage – €700/Month

- 13/14th Month – No

- Working hours – 40/Week

- Holidays – 4 weeks for workers up to 33 years old, 5 weeks therein after

- Sick pay – Days 1-3 at 25%, days 4-10 at 55% (Employer), 11+ days at 55% (Social Security)

Spain

Local Employment Facts

- Minimum wage – €965/Month

- 13/14th Month – Both paid July and Dec

- Working hours – 40/Week

- Holidays – 30 calendar days

- Sick pay – 4-15 days at 60% (Employer)

Sweden

Local Employment Facts

- Minimum wage – No minimum

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 25 days

- Sick pay – 2-14 days at 75-80% (Employer)

Switzerland

Local Employment Facts

- Minimum wage – Differs per Canton (Between 19-24 CHF per hour)

- 13/14th Month – Not compulsory - 13th month very common

- Working hours – 40-44/Week

- Holidays – 4 weeks if between 20-50 years old, under 20 and over 50 - 5 weeks.

- Sick pay – 3 weeks paid leave in the first year (Employer)

UK

Local Employment Facts

- Minimum wage – £10.42 per hour

- 13/14th Month – NO

- Working hours – 40/Week

- Holidays – 5.6 weeks per year

- Sick pay – £109.40 for up to 28 weeks

Ukraine

Local Employment Facts

- Minimum wage – 6700 UAH per month

- 13/14th Month – Not compulsory

- Working hours – 40/Week

- Holidays – 24 days after the first 6 months

- Sick pay – Days 1-5 (Employer) therein after by Social Security, the amount depends on the duration of employment i.e 0-3 years 50%, 3-5 years 60%, 5-8 years 70% and 8+ years 100%

USA

Local Employment Facts

- Minimum wage – $7.25 federal minimum

- 13/14th Month – NO

- Working hours – 40/Week

- Sick pay – Varies state to state

All Rights Reserved | BINKS OVERSEAS