INTERNATIONAL EMPLOYER OF RECORD PAYROLL

Working on an Employer of Record (EoR) basis means Binks Overseas becomes the in-country employer. We handle all employment contracts and take responsibility for the employment.

This is an excellent option for companies who don't have the capacity to establish their own in-country entity and to ensure compliance with local tax and employment laws.

Because we use a combination of internally managed payroll and outsourced payroll partners who are specialists in employment and tax laws in-country we can ensure local compliance.

Our knowledgeable team are experienced in using specialist payroll software which report electronically to the relevant tax authorities.

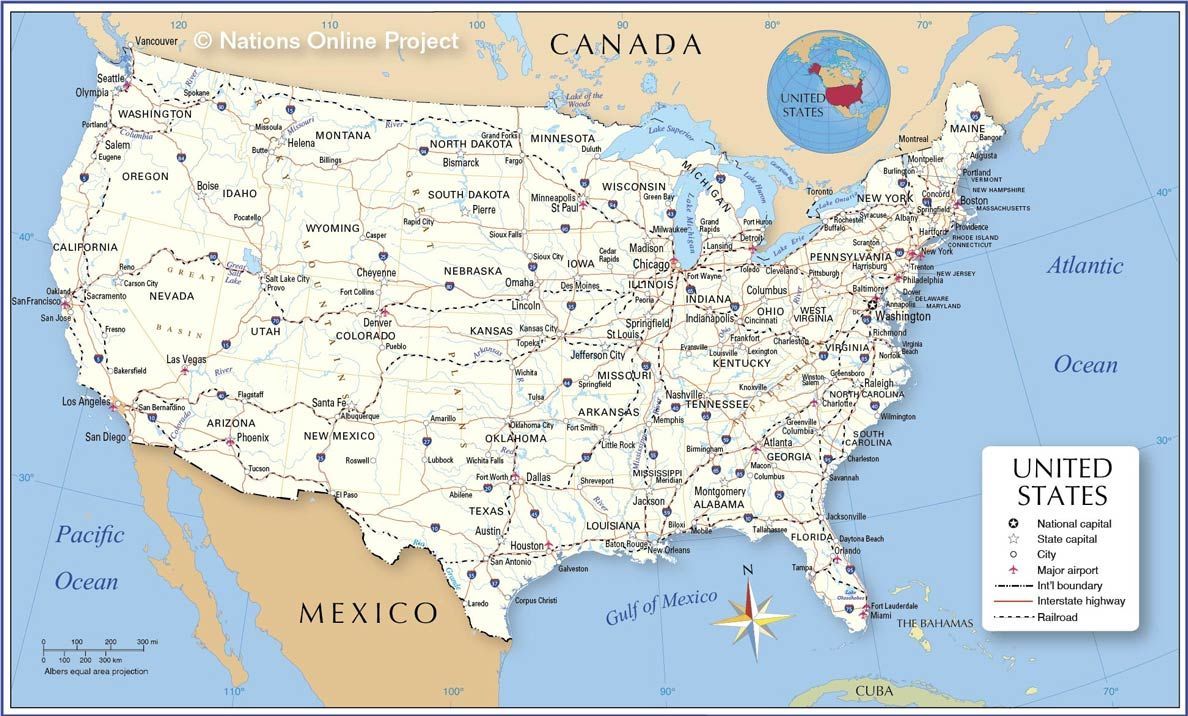

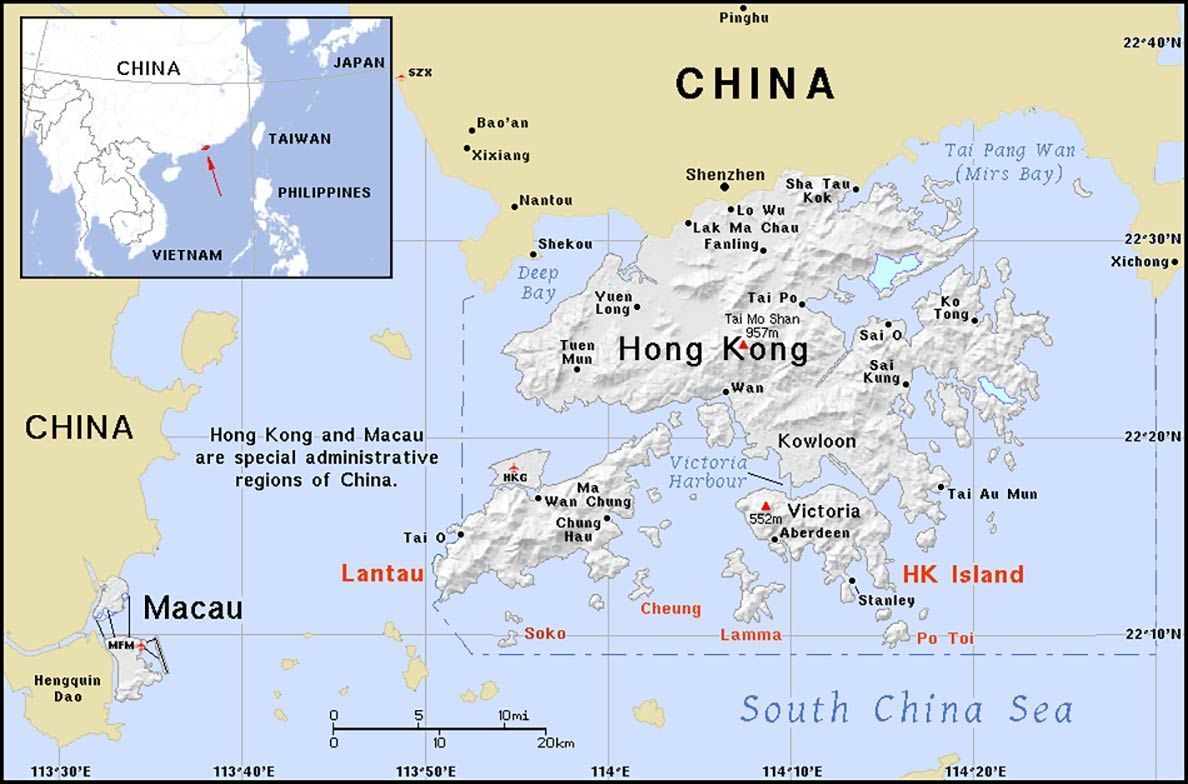

Click on the country on the map below to see details of the payroll solutions in that country

The Process

1.

The client will contact Binks to enquire about an EoR solution in the country required.

2.

Confirmation of an available payroll solution and the costs per calendar month are confirmed by Binks.

3.

The client supplies a summary of the assignment. This may include a contract or contract details and a work order or call-off summary.

4.

The new employee is invited to the payroll by the onboarding team who draft a bespoke employment contract that mirrors the assignment brief given. All employment contracts are locally compliant according to relevant employment legislation

5.

A welcome email is sent to the employee with the contract and explaining what documents are required – typically passport, proof of address and full bank details.

6.

Onboarding completed, the employee can begin the work

7.

Every month the employee or client will send a timesheet (or similar) or, if on a fixed salary, confirm all relevant payroll data for the monthly salary to be calculated

8.

Payroll is run for the month and the employee is provided with a payslip.

Fees & Employers Costs

Fees are calculated on a calendar month basis, the fee may be paid by the employee (where it is deducted from gross salary) or the client may choose to cover the cost. Employers employment-related costs are also treated in the same way.

Contact Us

Additional Services

As the employer of record Binks is able to support workers with applications for ID cards and mandatory regulatory paperwork for specific industries - such as construction sites.

This includes:

A1 Applications

ID06 Cards (Sweden)

HMS Kort (Norway)

Valltti & Limosa Cards (Finland)

Dutch BSN Numbers

Norwegian D Numbers

Danish CPR Numbers

Posted Worker Notifications

Austria

Austria's average wage is high, 25% higher than the European average and even when you consider higher living costs, your purchasing power is still in the top five countries in Europe. There's no minimum wage. Progressive taxation starts at 0% and hits 55% if you earn over €1m

Croatia

Croatia has mixed economy with slightly lower than average wages but also a lower cost of living (unless you're living close to a tourist destination). It has progressive taxation from 15% through to 32%, Employee national insurance of 20% and Employer NI of 16.5%.

Czech Republic

The Czech average wage has risen considerably in the last few years but in 2023 was still about 2/3 of the European average. Taxes are 15% up to CZK 1.676m(£58k) p.a. with 23%. Employees NI at 11.6% and Employers NI at 34%.

Denmark

Denmark's wages are considerably higher than the European average which is attributed to strong labor unions, collective bargaining agreements, and a focus on high-value industries. Income tax in Denmark's tax system is known for its high tax rates and comprehensive welfare. Taxes are levied both at a national and municipal level so your taxation will vary by location.

France

France has progressive taxation starting at 0% through to 45% if you earn over €168k. The average wage is, well, fairly average - higher than Eastern and Southern Europe but lower than Scandinavia and the Germanic countries. However, it offers a good standard of living thanks to France's strong social safety net, public infrastructure, and relatively low cost of living.

Finland

Finland has an average salary around 25% higher than the European average (though probably lower than Luxembourg, Denmark, Ireland, and Belgium). However your purchasing power levels out due to a high cost of living. Income tax is progressive starting at 12.64% up to 44% if you earn over €150k. Finland works on a personal tax card system where your tax burden is calculated individually.

Germany

Germany's average salary is high compared to the rest of Europe and it offers the highest average salary among the EU's four largest economies (Germany, UK, France, Italy). Your purchasing power is also good thanks to a reasonable cost of living. There's progressive taxation from 0% up to 45% for earnings over €277,826. Employee's NI is 20%, Employer's NI is 21.5%